Fast, Flexible Lending. Built for Physicians.

You’re a doctor—enough said. Access physician-first financing at unmatched speed with flexible solutions and personalized support tailored to your needs.

Your specialty is our focus.

Physicians don’t follow a traditional financial path—and neither do we. We skip outdated applications, irrelevant criteria, and one-size-fits-all loans to deliver fast, flexible financing backed by insights from years of working with medical professionals.

Why Physicians Choose 4FiMD

We serve physicians, not just any borrower. From residents to specialists, our programs are built around your training, timeline, and income trajectory.

Specialization

Get approved in as little as 48 hours with terms designed for physicians. No piles of paperwork or unnecessary requirements.

Fast, Flexible Terms

We are not just lenders; we are your financial allies. No surprises, no hidden fees, just smart capital when you need it most.

Trust & Transparency

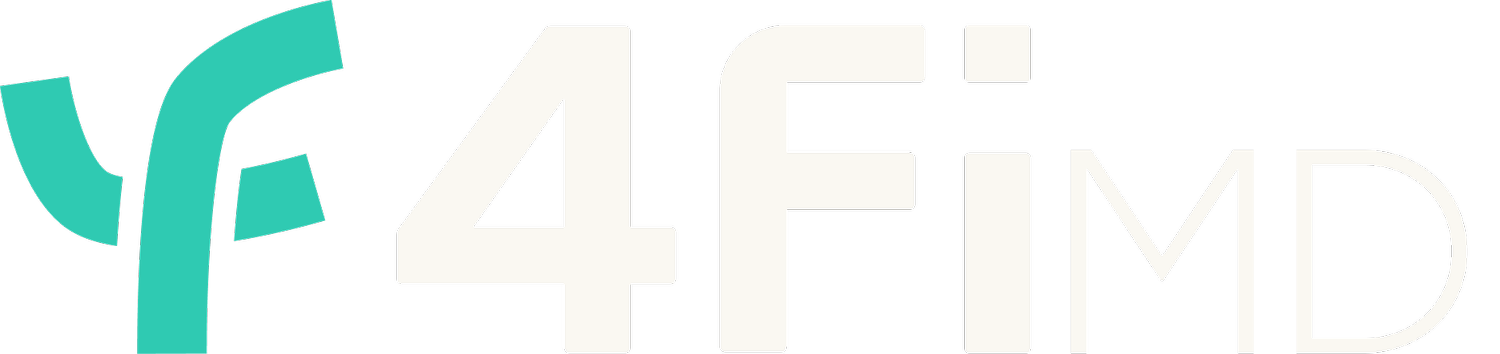

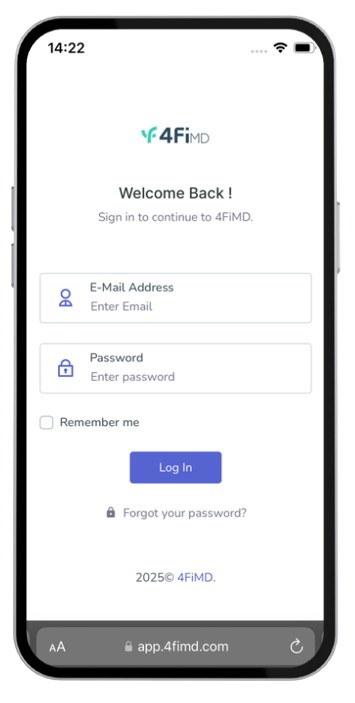

How it works

Getting started is simple.

1. Pre-Qualify Fast

Enter your loan details in minutes. No credit impact, no commitment.

2. See Your Estimate

Get an instant, personalized offer with options tailored to you.

3. Secure Funds

Complete your application and get funded in 72 hours.

View your estimate. No credit impact. No commitment.

Not all lenders are created equal.

Speed to funding

<48-72 hrs

3-8 weeks

Industry specialization

Physicians

Generic

Paperwork requirements

Minimal

Heavy

Flexibility for your needs

High

Low

Bank

Skip the banks. Skip the stress.

We simplify financing so you can move fast—with clear terms, no red tape, and funding in days, not months.

FAQs

-

Business Loans can be used to cover any business purpose including but not limited to practice development (supplies, working capital, purchasing medical equipment and technology), expansion (i.e., opening a new office or hiring additional staff), and acquisition (i.e., group buy-in or partner buyout).

-

No. Applying for a loan will not impact your personal credit. We only perform a soft pull of your credit when you apply, so your score will remain intact. After you’re funded, your 4fiMD Loan will not be reported to the credit bureaus. However, if your account becomes delinquent, we can report the delinquent trade line to the bureaus. -

A business loan is a loan that meets the business financing needs of a practicing physician.

-

With a business loan, you’re able to purchase or replace various types of equipment, including but not limited to:

X-ray imaging equipment

Exam tables and patient chairs

Diagnostic and surgical equipment

Whatever your practice needs to thrive, you can depend on our financing to support your success.

-

Business loans can be customized to fit your financing needs. Repayment terms of up to 12 years, which can significantly lower your monthly payments and boost your cash flow.

-

Yes, total debt including student loans are factors in credit decisions. But if your student loans are deferred we will take that into consideration as well.

-

Yes, we require that you have an active medical license to receive funding.

-

4fiMD considers many factors including credit and income you provide at the time of your loan application.

-

No, we evaluate both personal and business income, among other factors, to make a loan decision.

-

No, there is no minimum requirement.

-

Our loans are secured loans. For commercial loans, 4fiMD files a lien on the business via a Uniform Commercial Code (UCC) filing.Item description

-

The interest rate is fixed.

-

No. Please refer to the Terms and conditions linked here: T&C